📉 Trump Family Quietly Trims WLFI Stake Amid Rising Scrutiny

Plus crypto majors and CRCL stock are both rallying into Friday market open

GM!

Today's top news:

Crypto majors rally into market open; BTC at $106k

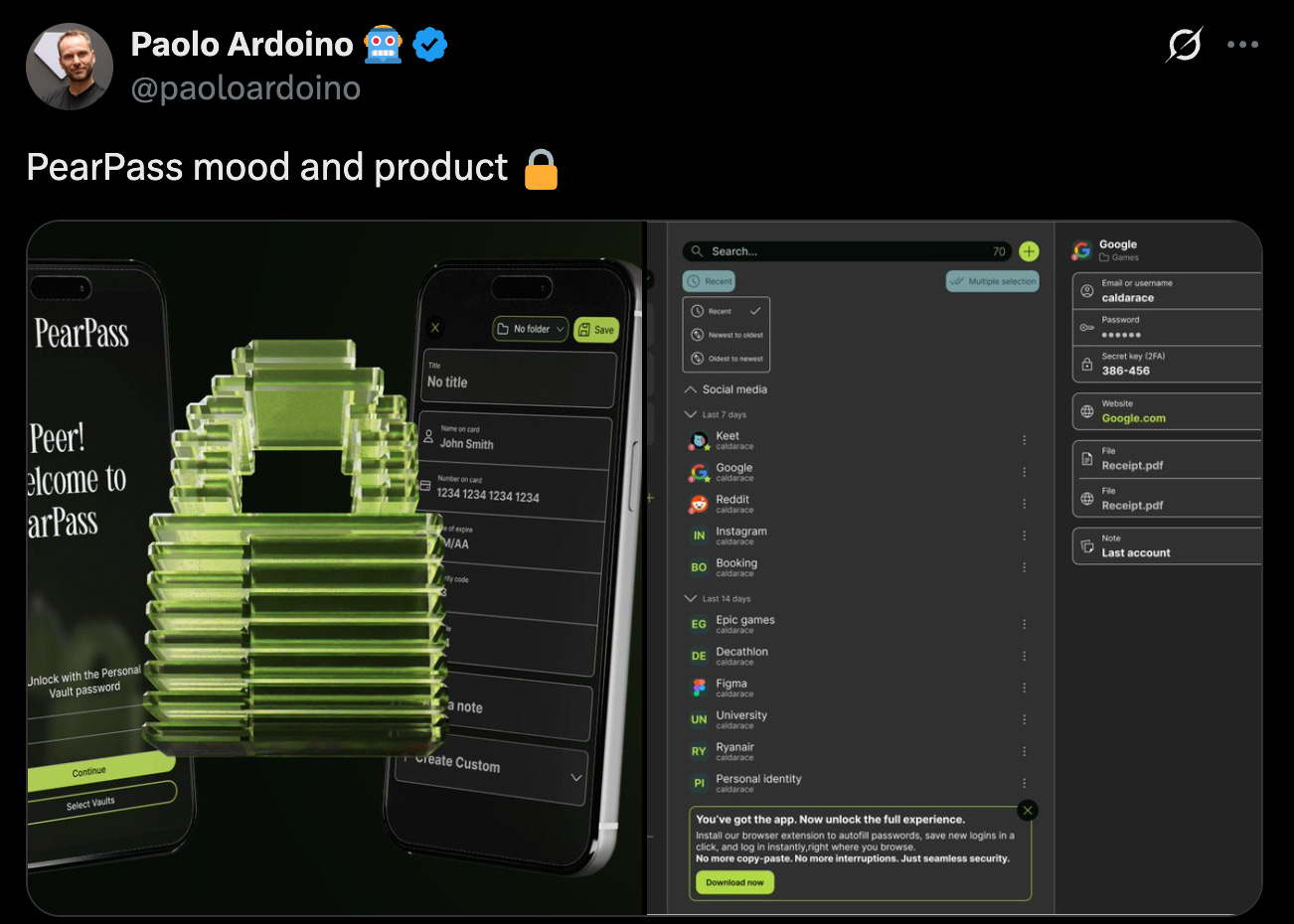

Tether CEO teases solution to 16B password hack problem

Trump family trims WLFI stake as token trades near $1B premarket

Kraken announces BTC staking via Babylon

REKT Drinks sells out of supply at first 7-Eleven event

📉 Trump Family Quietly Trims WLFI Stake Amid Rising Scrutiny

Donald Trump’s crypto ties are making headlines again.

This time, because he’s quietly cashing out.

📌 What Happened:

The Trump-affiliated entity DT Marks DEFI LLC has reduced its stake in World Liberty Financial (WLFI) from around 60% to approximately 40%, according to updated financial disclosures reviewed this week.

That marks the latest in a string of sell-offs since late 2024, when the Trumps reportedly controlled 75% of the firm.

The move comes as WLFI gains momentum around its USD1 stablecoin and continues to lobby for pro-crypto legislation like the GENIUS Act, which Trump himself is pushing to fast-track.

And of course, on the back of CRCL’s parabolic run to $200 and a $48B market cap.

While the campaign hasn’t commented publicly, Forbes estimates the Trump family could’ve made over $190 million from the WLFI divestments, with Trump personally netting around $135 million.

The SEC and Senate Banking Committee have both increased scrutiny on the relationship between WLFI and the Trump campaign.

🗣️ What Are They Saying:

Sen. Richard Blumenthal (D-CT) has been investigating Trump’s ties to World Liberty Fi since May:

“WLFI’s refusal to answer even the most basic questions about President Trump’s financial entanglements with the company raises serious concerns. And I will continue demanding transparency for the American people.”

Why It Matters:

The Trump campaign is actively shaping crypto regulation, while the family has been diving deeper and deeper into different crypto companies and relationships.

Which has driven pushback from Democrats and has risen concern levels of most who are monitoring the situation.

This reduction signals possible strategic moves to distance the Trump family from WLFI, as Congress escalates oversight of crypto ties. Which would be a good thing.

Or perhaps they are simply cashing out one venture to prepare for the next.

Let’s hope that’s not the case, but time will tell…

🌎 Macro Crypto and Memes

A few Crypto and Web3 headlines that caught my eye:

Crypto majors are green; BTC +1% at $106,000, ETH +1% at $2,550, XRP +1% at $2.17, SOL +2% at $148

KAIA (+13%), SEI (+12%) and IP (+8%) led top alt movers

CRCL stock is up another 10% premarket after Trump’s pressure on the House to pass the Genius Act

Tether CEO Paolo teased a solution ‘PearPass’ to the ongoing issue of passwords being leaked after yesterday’s 16B leak

An entity linked to the Trump family trimmed its stake in the World Liberty Financial DeFi project from 60% to ~40% amid Senate scrutiny; meanwhile WLFI trades at $940M premarket

Visa has expanded its stablecoin support throughout Central and Eastern Europe, the Middle East, and Africa (CEMEA), and entered into a strategic partnership with African crypto exchange Yellow Card

London-based neobank Revolut (55M+ retail, 500K business clients across 160 countries) is in discussions with at least one crypto-native partner to launch its own stablecoin

Elon Musk’s X (Twitter) is gearing up to offer in-app investing and trading, part of its “everything app” ambitions

In Memes

Memecoin leaders were mostly green; DOGE +1%, Shiba +2%, PEPE even, TRUMP +1%, BONK +2%, SPX -3% & FARTCOIN -4%

GOR was the top Solana mover, running 280% to $33M; Vibecat (+11%) and Chillhouse (+11%) other notable movers

💰 Token, Airdrop & Protocol Tracker

Here's a rundown of major token, protocol and airdrop news from the day:

Plasma plans to launch its mainnet “late summer” (~by late September) after a substantial $1 B deposit pre-sale for its XPL token

Kraken announced its BTC staking via Babylon protocol, rewarding users in BABY tokens

Jupiter has paused DAO votes for the rest of 2025, citing lack of trust and plans to come back with a new governance model in 2026

Kinetiq announced iHYPE as the first institutional liquid staking token for the Hyperliquid eco

REKT sold out all of its drinks at the 7-11 debut event in LA yesterday

Gradient Network raised $10M in seed funding (led by Pantera, Multicoin) to develop decentralized AI infrastructure; Project 11 secured a $6M seed round (co-led by Variant and Quantonation), aiming to shield Bitcoin’s network against future quantum-computing threats

🤖 AI x Crypto

Section dedicated to headlines in the AI sector of crypto:

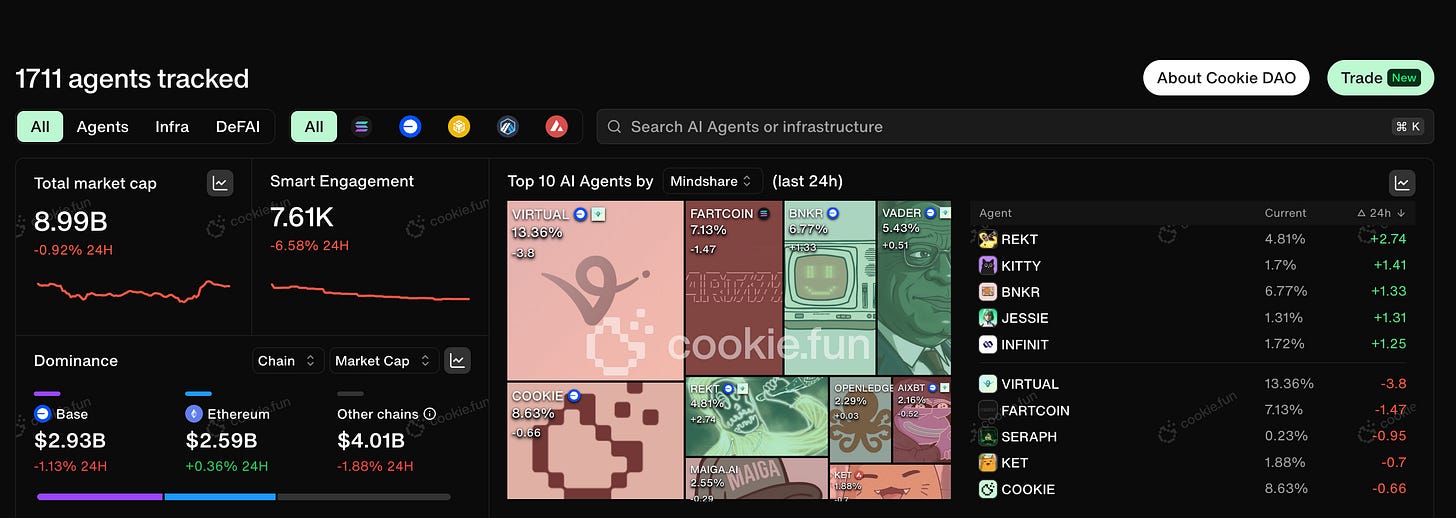

Overall market cap fell 1% to $9B, leaders mostly chopped

FARTCOIN (-5%), VIRTUAL (+1%), ai16z (even), FAI (even) & AIXBT (-2%)

GAME (+8%) led top movers

Virtual led mindshare with a 13% share; Fartcoin and Cookie were next; REKT top mindshare mover

🚚 What is happening in NFTs?

Here is the list of other notable headlines from the day in NFTs:

ETH NFT leaders rebounded; Punks +2% at 41 ETH, Pudgy +1% at 9, BAYC -1% at 11.5 ETH

Moonbirds (+22%) and Nakamigos (+20%) were notable movers

BTC NFT leaders were mixed; Taproot Wizards even, Bitcoin Puppets -5%, NodeMonkes -1%, OMB -2%, Quantum Cats even

Abstract NFTs were mostly green led by Abstract Firsts and Bearish

--------------------------------------------------------------------------------------

Enjoy this write-up and/or want to sponsor the Morning Minute? Follow along with me on Twitter @tyler_did_it or reach out via dm